Liang Gang1,Zheng Shaojing2,Zhang Tingshen3

1.Guangzhou Institute of Science and Technology,510540,GuangZhou,GuangDong, China 2. Guangxi University of Finance and Economics, Nanning City, Guangxi Pr ovince, 530001,3. Haikou University of Economics, Haikou City, Hainan Provinc e, 5711322)

Abstracts :In the course of rapid development, we have ignored ecological deforestat ion and discharged industr ial waste water into natural r ivers, resu lt ing in r iver pollut ion. Solving ecolog ical prob lems today is the most important thing in our development. In order to solve the prob lem of cap ital financing, a lot of financia l instruments have been der ived, includ ing asset secur it izat ion. The use of asset secur it izat ion tool financing wi ll make the l iquidity of the assets of the project increase from low to high, and it wi ll a lso reduce the var ious r isks faced. The industr ies or companies that are suitable for large fund ing gaps and long account ing per iods wi ll make the two gain win-win resu lts.

In the f irst part, the orig in of asset secur it izat ion is introduced br ief ly, and the background and development of China’s development make it understand this financial instrument. The second part main ly introduces the development trend of asset securit ization in China and the current s ituation of sewage treatment in environmental protect ion projects in China. The third part is a simp le introduction to Guangxi Greentown Waterworks Co. Ltd. and analysis of its sewage treatment capacity. The fourth part is to carry on the scheme design of the water treatment in Greentown. The fifth part is the analys is and suggest ion of the poss ible prob lems in the des ign. The s ixth part is the summary.

Key words :Green finance;Asset secur it izat ion;Guangxi Nanning Waterworks Co.,Ltd

- Introduction

1.1. Background and significance of th e research

Asset securitization originated in the United States and is the most rapid ly developing financial innovation tool in the global financial industry since the 1970s. It has now become one of th e most important financing tools in the US capital market. China’s asset secur itization market started later than dev eloped countries and has a relatively l ow level of development. The characteri stics of asset securitization are of gr eat significance for industries with la rge funding gaps, stable returns, and l ow risks, which can help alleviate gove rnment burdens. The burden onenterprises is to distribute financia l pressure in multiple aspects. This a rticle believes that the current devel opment direction of asset securitizati on in China can be achieved by practic ing green environmental protection en terprises, such as the enterprises inv olved in sewage treatment in this arti cle. Expand the influence of asset sec uritization as a financial tool and re duce the financing burden of enterpris es to achieve a win-win situation.

1.2.literature review

The introduction of asset securitization in our country is relatively short and started relatively late, and the relevant system and regulations have not yet been perfected. So when it comes to asset securitization, we rely more on the experience gained from relevant research and practice abroad, and at the same time, we need to combine it with China’s national policies to find a suitable asset securitization design for our country. In the past decade, Chinese scholars have conducted research on various aspects of asset securitization. Hong Yanrong (2008) studied the institutional design and guarantee of liquidity for asset securitization products, and concluded that the foundation of China’s securities marketization is its liquidity. The foundation and guarantee of the liquidity system can be studied from three aspects: market environment, policies, improved trading platform mechanisms, and professional and mature market entrants. Wang Baoyue (2009) conducted research on the risks of asset securitization and pointed out that risk control requires the establishment and improvement of risk warning systems, emergency response mechanisms for sudden events, and vigilance against the erosion of “soft political power”. Wang Yandong (2010) conducted research on the construction of independent SPVs and the realization of real asset sales in the bankruptcy isolation mechanism of asset securitization. She introduced that the advantage of asset securitization is the bankruptcy isolation mechanism, and the core of the bankruptcy isolation mechanism is SPVs. Then, she analyzed the implementation of the bankruptcy isolation mechanism and put forward suggestions [3]. He Kai (2010) analyzed the core and foundation of accounting issues in asset securitization, namely accounting recognition and measurement, and explored a suitable model for China by combining international asset securitization with the development of asset securitization in China. Na Mingyang (2011) analyzed the causes of asset securitization and studied the relationship between asset securitization and financial development. Asset securitization has a certain promoting effect on the development and stability of finance. Zheng Caiqin’s (2012) research shows that the construction of risk isolation mechanisms in asset securitization is a key focus of China’s asset securitization market, and points out that there are problems in it. She believes that the construction of risk isolation mechanisms in asset securitization in China needs to improve relevant laws, and provide correct guidance for the practice of asset securitization in China. Liu Qi, Chu Siwen, Gao Yue, and Li Ying (2013) analyzed the phenomenon of “bank reluctance to lend” in forest tenure mortgage loans and conducted a feasibility analysis of asset securitization financing in forestry [7]. Liu Zhongjie (2014) studied the incentive of financial innovation and development through the improvement of legal regulations, analyzed the practical experience at home and abroad and the legal environment of financing lease securitization in China, and proposed further improvement suggestions to promote industrial upgrading and economic structural adjustment [8]. Lin Hua, Ge Qianda, and Huang Changqing (2015) conducted a separate analysis on the impact of replacing business tax with value-added tax on asset securitization taxation. Dai Yuzan and Guo Hongyu (2016) analyzed that securitization of non-performing assets can activate non-performing loans in banks, improve the disposal and recovery rate of non-performing assets, and generate a variety of products to meet the different needs of various investors. But in order to accelerate the development of non-performing asset securitization in China, it is necessary to fully understand the dual nature of securitization in dealing with non-performing assets, improve domestic regulations, and solve the problems that arise in the development of non-performing asset securitization. Shen Chaohui (2017) conducted research on the fragility of the legal structure in corporate asset securitization, and the solution is to establish an open trust system to move China towards an open Chinese trust system.

2.The overall situation in our country

2.1.Financial Instruments – Asset Securitization

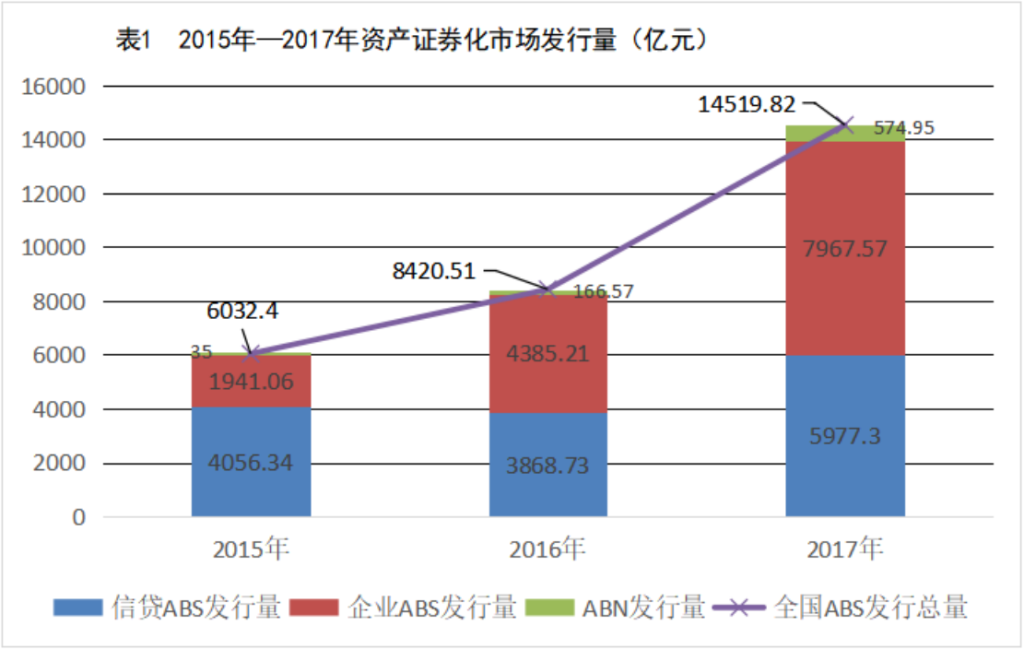

Asset securitization, in simple terms, refers to the activity of designing and packaging certain assets with low income fluctuations, predictable future cash income but long payment terms and lack of liquidity into a basic asset, and selling asset-backed securities in the market to finance the future cash flows of the asset. In fact, it means designing, packaging, and reissuing assets with low liquidity, converting them into assets with high liquidity, and facilitating their circulation in the market. According to Table 1, from 2015 to 2017, China’s asset securitization market showed an increasing trend year by year. In just three years, the issuance volume of asset securitization market has increased from 603.24 billion yuan per year to 1451.982 billion yuan per year, more than doubling. As shown in the figure, in 2015, the issuance of credit ABS was about twice that of enterprise ABS and ABN, accounting for 67% of the total; In 2016, the issuance of enterprise ABS increased rapidly, surpassing the issuance of credit ABS within a year, accounting for 52% of the total, while the issuance of credit ABS accounted for 46% of the total, a decrease of 21% compared to the previous year. In 2016, the issuance of ABS by enterprises continued to expand rapidly, accounting for 55% of the total, and became the top issuer in the asset securitization market for two consecutive years.

Data source: Development Report on Asset Securitization from 2015 to 2017

According to incomplete statistics, as of the end of 2017, there were 23 issuance projects of green asset securitization. These projects involve green industries such as sewage treatment, new energy generation, and waste disposal, and the underlying assets are assets with stable cash flow and strong predictability of returns. The basic asset types of asset securitization products are becoming increasingly diversified, and the trading structure of products is constantly changing to better adapt to China’s national conditions. First order products in various markets are constantly emerging. From this, it can be seen that green asset securitization has developed rapidly in recent years, and due to its characteristic of stabilizing asset cash flow, which is in line with China’s national policy trend, it has been sought after by issuers and investors.

2.2.Current situation of sewage treatment

2.2.1Environmental pollution investment

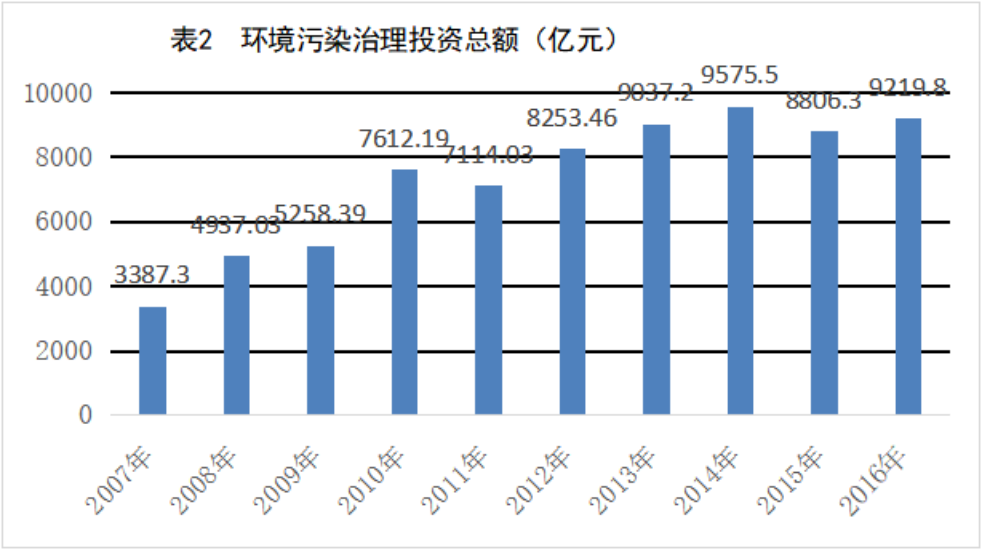

According to Table 2, China’s investment in environmental pollution was 338.73 billion yuan in 2007, and by 2016 it had reached 921.98 billion yuan. In the past decade, China has attached increasing importance to environmental pollution and has taken many measures to address it, investing heavily in management and governance.

Data source: National Bureau of Statistics

2.2.2National wastewater discharge volume

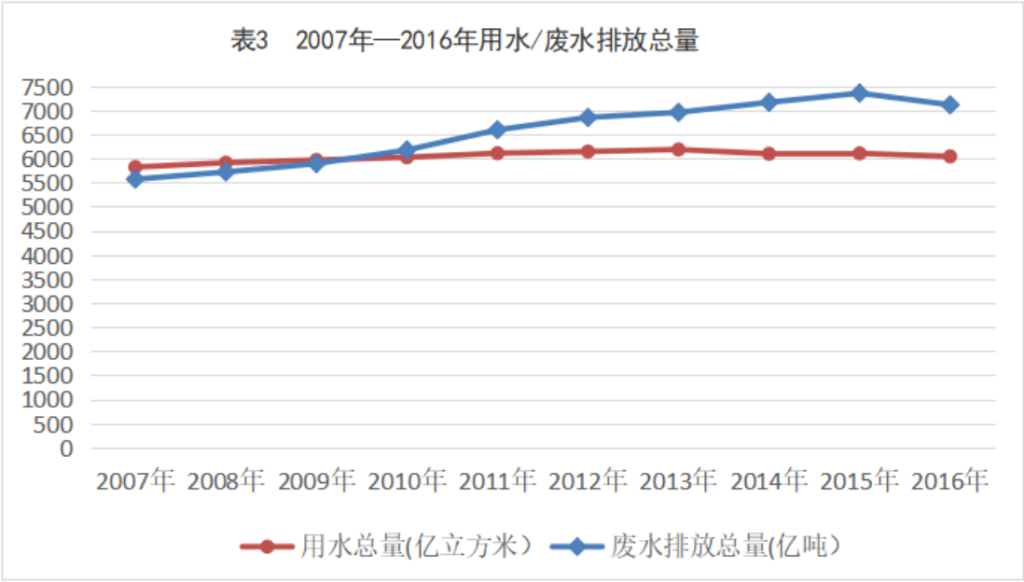

Table 3 shows the total water usage and wastewater discharge for each year from 2007 to 2016. As can be seen from the graph, with the continuous growth of urban water use scale, the amount of urban sewage discharge also increases. Moreover, the annual growth rate of wastewater exceeds the total amount of water used, so sewage treatment is urgent.

Data source: National Bureau of Statistics

2.2.3The situation of urban sewage treatment in China

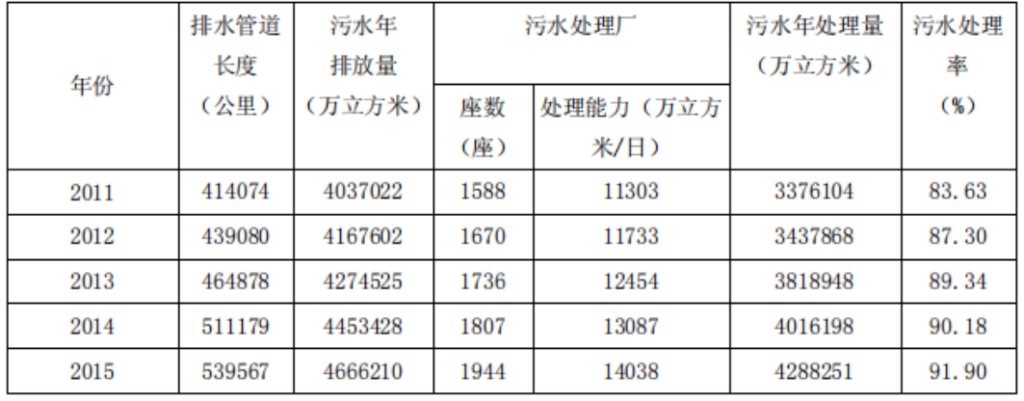

In recent years, the country has increased its efforts in environmental protection construction and vigorously developed the sewage treatment industry. According to the content of the “Thirteenth Five Year Plan for National Urban Sewage Treatment and Recycling Facilities Construction”, the planning goal is to end by 2020, and corresponding regulations have been made for sewage treatment related facilities and black and odorous water bodies. The main requirement is that by 2020, the sewage treatment rate in cities should reach 95%, the sewage treatment rate in county towns should not be less than 85%, and the sewage treatment rate in towns should reach 70%. It is precisely under the strong promotion of national policies that China’s urban sewage treatment capacity has made significant progress in recent years. From Table 4, it can be seen that the national sewage treatment rate has gradually increased from 2011 to 2015.

Table 4 National urban drainage and sewage treatment situation

Data source: 2015 Urban and Rural Construction Statistical Yearbook

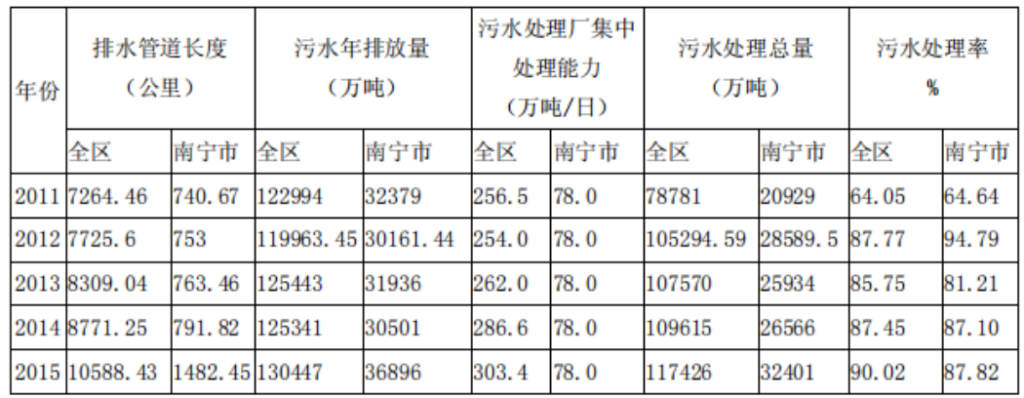

Table 5 shows the drainage and sewage treatment situation in the entire Guangxi region and Nanning city, and various indicators of the sewage treatment industry are also showing a steady growth trend. From the graph, it can be seen that the annual discharge of sewage in Nanning city fluctuates between 300 million tons and 370 million tons. The annual discharge of sewage in Nanning city is very large, which once again reminds us that if most urban sewage flows directly into our rivers without sewage treatment, it will cause water pollution, which will be difficult to restore and directly lead to serious pollution of the ecological environment.

Table 5 Drainage and sewage treatment in Guangxi Autonomous Region and Nanning City from 2011 to 2015

Data source: Guangxi Statistical Yearbook 2011-2015

3. Guangxi Greentown Water Co., Ltd

Guangxi Greentown Water Co., Ltd. is a large water company. The company successfully went public in 2015 with the listing code 601368. The company’s business philosophy is to focus on developing the production and sales of urban tap water and urban sewage treatment, using capital management as a means, implementing scientific and standardized management, improving economic and social benefits, and enabling shareholders to obtain satisfactory economic benefits. The company has the highest production capacity and scale in the industry in Guangxi, and has obtained the franchise rights for water supply and sewage treatment, providing the vast majority of water supply and sewage treatment services for Nanning and its surrounding areas, occupying an absolute market position in Nanning.

3.1.Main business

The company’s main business is divided into two categories: water supply business and sewage treatment business. The water supply business refers to the transportation and sale of tap water produced by the company to users through the water supply network, including urban residents, industrial and commercial users, and other users. The company carries out water supply business in the central urban area of Nanning and has eight subordinate tap water production units. The sewage treatment business refers to the company collecting sewage through the sewage pipeline network and concentrating it in the sewage treatment plant for sewage treatment, and then discharging the tail water that meets national discharge standards into natural water bodies. The company carries out sewage treatment business in Nanning and five surrounding counties, with seven sewage treatment units under its jurisdiction, namely Jiangnan Sewage Treatment Plant, Langdong Sewage Treatment Plant, Wuming County Sewage Treatment Branch, Binyang County Sewage Treatment Branch, Hengxian County Sewage Treatment Branch, Shanglin County Sewage Treatment Branch, and Mashan County Sewage Treatment Branch.

3.2.Cost of sewage treatment

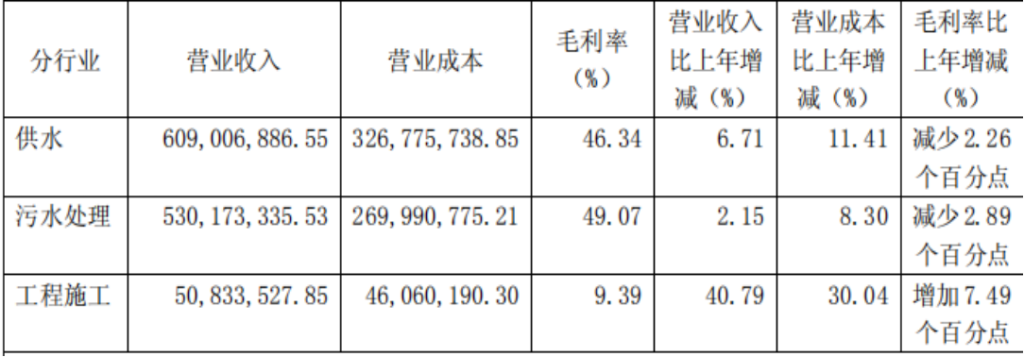

From Table 6, it can be seen that the operating revenue and costs of water supply and sewage treatment businesses increased in 2016 compared to 2015, but the growth rates of water supply and sewage treatment costs were higher than their revenue growth rates. The gross profit margin of the water supply business decreased by 2.26 percentage points year-on-year, mainly due to an increase in operating costs such as repair fees, electricity fees, and water resource fees compared to the same period last year. The gross profit margin of the sewage business decreased by 2.89 percentage points year-on-year, mainly due to the change in the value-added tax policy for sewage treatment services from exemption to a 17% tax rate since July 1, 2015, which reduced gross profit; Secondly, operating costs such as sludge disposal fees and depreciation expenses have increased compared to the same period last year.

Table 6 Main business situation in 2016 (Yuan)

Data source: Annual Report of Guangxi Greentown Water Co., Ltd. for 2016

3.2.1Construction costs for sewage treatment plants and collection pipelines

In 2016, there were five ongoing or soon to be completed projects in Nanning City, namely the Wuxiang New Area Sewage Pipeline Phase I Project, the Henan Water Plant to Liangqing Pressure Station Factory Pipe Basic Completion Project, the Nanning Henan Water Plant Renovation and Expansion Project, the Shajing Funing Avenue Sewage Pipeline Under Construction Project, and the Greentown Water Dispatch and Testing Center Project. These projects were either under construction or just completed in 2016 and have not yet been put into use. From the table, it can be seen that the actual investment amount will be slightly higher than the planned amount. In the 2016 annual report, it was stated that the company plans to invest approximately 1.35 billion yuan in water supply and sewage treatment facilities such as the Langdong Sewage Treatment Plant Phase IV, Jiangnan Sewage Treatment Plant Water Quality Improvement and Phase III, Greentown Water Testing Center Building, Chencun Water Plant Phase III, Guangxi ASEAN Economic and Technological Development Zone Water Plant Phase I Expansion Project, and Nanzhan West Road Water Supply and Pressure Station in 2017. In early August 2017, the company planned to raise approximately 1.6 billion yuan through a non-public offering of no more than 147 million shares, which will be used for water quality standards and other projects for water supply and sewage treatment plants. After the completion of these projects, the company’s water supply and sewage treatment capabilities will be further enhanced. From this, it can be seen that the amount of capital cost required for sewage treatment is relatively large. The release of the “13th Five Year Plan for the Construction of Sewage Treatment and Reuse Facilities” has put forward higher requirements for the construction of sewage treatment facilities, sewage treatment capacity, and sewage treatment standards in urban areas across the country. This also requires sewage treatment companies to do better in the construction of sewage treatment facilities and other aspects.

3.2.2Operation and maintenance costs of sewage treatment plants

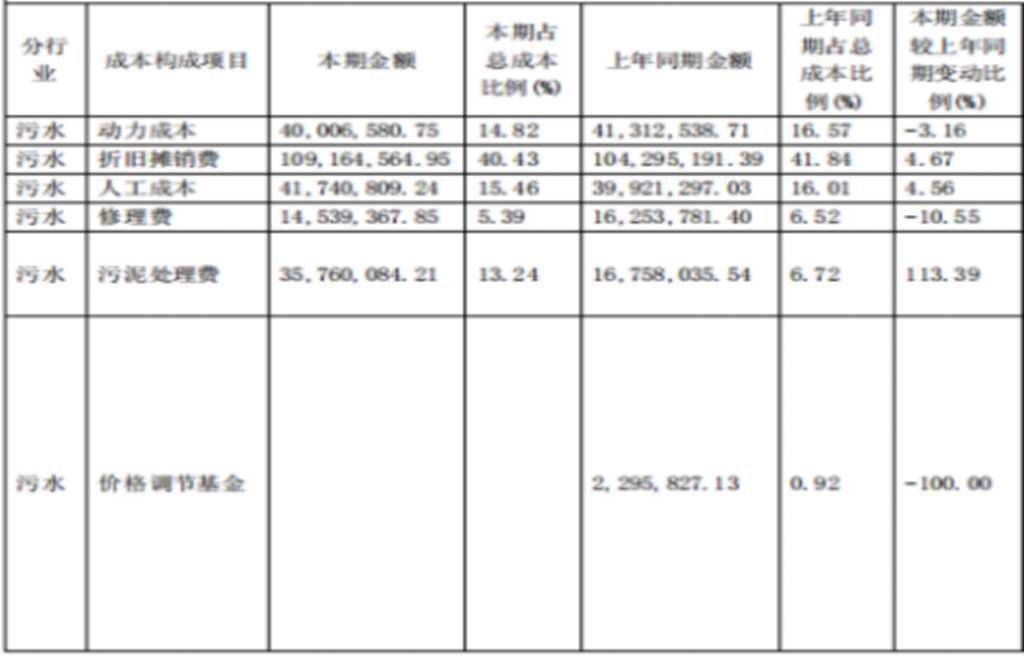

The costs incurred during the operation and maintenance of sewage treatment plants can be seen from Table 7 Sewage Treatment Costs. It mainly consists of several items such as power cost, depreciation and amortization cost, labor cost, repair cost, sludge treatment cost, price adjustment fund, etc. From the graph, it can be seen that the biggest fluctuation in 2015 compared to 2016 was in sludge treatment fees. This is due to the increase in sludge disposal volume and the rise in disposal unit price. This also reflects that in sewage treatment, every action is taken, and the increase in sludge treatment fees has led to an overall cost increase in sewage treatment. And the price adjustment fund is zero in 2016 because sewage treatment fees have been updated to become non tax revenue of the government.

Data source: Annual Report of Guangxi Greentown Water Co., Ltd. for 2016

3.3.Source of Funds

3.3.1Income

The income from the sale of tap water by the company, the income from providing labor services, the construction contract during the construction of the sewage treatment plant, and finally the interest on the use of company funds by others.

3.3.2fiscal appropriation

A significant portion of the company’s sewage treatment construction is funded by the national government, but the funds allocated by the national government are limited and can only be used as a form of subsidy support, and cannot be disbursed without consideration. The investment cost in the construction and maintenance of sewage treatment plants is high, and excessive reliance on local government investment can lead to increased pressure on local governments. Other more important social services that require local government investment cannot receive national financial appropriations.

3.3.3bank loan

The company can obtain bank loans due to its fixed assets such as sewage treatment plants. For example, in mid-2016, the company signed a “RMB Working Capital Loan Contract” with China Construction Bank Corporation Nanning Jiangnan Branch, with a contract amount of 330 million yuan; The company has signed a “Project Financing Loan Contract” with the Nanning Branch of Industrial Bank Co., Ltd., with a contract amount of 215 million yuan. But fixed assets are limited, and the loan processing time for banks is long, so each loan needs to wait for a long time.

3.3.4Other sources of funding channels

One reason is that the company publicly issued corporate bonds in 2016, and the first issue was completed on September 13, 2016, with an actual issuance scale of 1 billion yuan. The first issue of corporate bonds is a fixed rate bond with a coupon rate of 3.09%; The second is to issue short-term financing bonds worth 250 million yuan.

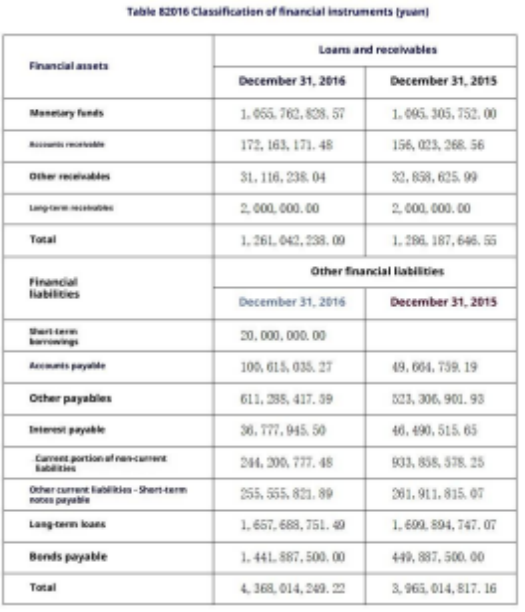

3.3.5funding gap

From Table 8, it can be seen that loans in 2015 and 2016 have gradually increased, reaching around 4.3 billion in 2016, which is a significant amount, while accounts receivable have remained at around 1.2 billion. In addition, it can be seen from the cost of sewage treatment that a large amount of funds are required for sewage treatment. However, in sewage treatment projects, fund collection is relatively slow, and basically loans are first borrowed to build sewage treatment plants or pay sewage treatment related fees, and then the loans are repaid after the funds are collected. There are bank loans involved in the loan, but the number of sewage treatment plants is limited and it is not possible to use them all as collateral for the loan, so the loan amount with the bank is limited. So the company has a large funding gap and needs to seek other financing methods.

Data source: Annual Report of Guangxi Greentown Water Co., Ltd. for 2016

3.4.The advantages of utilizing asset securitization

The reason for the large funding gap in sewage treatment is the high initial capital cost and long cycle required for the construction of sewage treatment plants. However, the recovery of funds depends on the long term and cannot be a one-time profit. It needs to be spread out every month, resulting in a slow recovery of funds and a large funding gap. The company has long relied on financial appropriations, bank loans, and relatively limited financing channels. Therefore, asset securitization can be used for financing sewage treatment. The company has the following advantages in utilizing asset securitization:

3.4.1Corporate Advantages

As the company is listed, using asset securities for refinancing is beneficial for generating positive short-term wealth benefits for the company. And they have issued corporate bonds, so they have rated the company and have a certain understanding of corporate financing. Therefore, when conducting asset securitization financing, they can effectively persuade shareholders. Compared to corporate bonds, asset securitization has significant liquidity. Greentown Water Company is a relatively large water company in Nanning City, with many business projects and good economic benefits. From this, it can be seen that the company’s financial returns are relatively stable, making it a suitable target for financing through securitized assets. And there are relevant preferential policies that stipulate that the corporate income tax rate applicable to the company in 2016 is 15%. After meeting technical standards and relevant conditions, sewage treatment labor can enjoy the policy of value-added tax collection and refund, with a refund rate of 70%.

3.4.2Low financing risk

When using asset securitization for project financing, due to the participation of multiple parties, the structure of the financing project is discussed by professionals from different perspectives, which makes the construction of the structure more reasonable and indirectly reduces the risk of the financing project.

3.4.3Credit guarantee structure

In bank loans or other types of loan financing methods, certain real estate or fixed assets need to be mortgaged and evaluated before the financing amount and other related matters can be confirmed. If there are problems with the real estate, the financing will be difficult to continue. In asset securitization financing, the project goal used for financing is future cash flow and does not require the use of fixed assets.

4.ABS Financing Plan Design

4.1.Case Study – Nanjing Public Holdings Sewage Treatment Special Plan

4.1.1Basic information of the original equity holder

Nanjing Public Holdings Group Co., Ltd. is currently responsible for water management business. As of the end of 2010, Nanjing Public Holdings had a total of 5 operating water plants, supplying water to over 3 million people.

4.1.2Relevant parties

There are five main stakeholders involved in this case, namely Donghai Securities, Shanghai Pudong Development Bank, Nanjing Urban Construction Group, Shanghai Far East Credit Rating Co., Ltd., and investors [15]. The original equity holder is Nanjing Urban Construction Group, with the aim of financing the expansion of sewage treatment facilities and using sewage treatment fees as the funding pool for the project; The custodian bank and guarantee institution for this special plan are Shanghai Pudong Development Bank, with the aim of providing guarantees for funds and supervising the flow of funds. The manager of the plan is Donghai Securities, with the aim of managing the account, converting the established fund pool into highly liquid assets and selling them externally, mainly responsible for the management of the asset and related plans; The rating agency is Shanghai Far East Credit Rating Co., Ltd. Its purpose is to evaluate the completed special project, give a credit rating, and publicly announce whether the credit rating of the project meets the standards, so that investors can have a preliminary understanding of the project and provide a guarantee for it. The plan share holder is the investor. After understanding the special plan and feeling that it has investment value, they will purchase shares to raise funds and officially complete the entire special plan process.

4.1.3Advantages of this special program

4.1.3.1There are various product design structures that are suitable for investors to choose from. This special plan designs securitization products into two types based on the different risks of underlying assets. Different financing risks correspond to different products, allowing customers to analyze their own situation and make investments accordingly. The design runs through the entire special plan.

4.1.3.2Taking sewage treatment in water management as the basic asset, the fund recovery period is stable, and water is the source of life. However, the water industry requires the construction, management, and maintenance of factories, so it belongs to an industry with high investment costs but long payment periods and low returns. Therefore, the competition pressure in the water industry is relatively low, and there is basically no situation where water companies go bankrupt due to fierce competition between industries. Therefore, the basic asset risk of this special plan is low.

4.1.4Similarities and Differences

The biggest similarity between Nanjing Public Holdings and Greentown Water is that both have businesses related to sewage treatment, but they also face the problems of high sewage treatment costs and long payment periods for fund recovery. The difference is that Nanjing Public Holdings is located in Nanjing City, which has a better and faster economic development than Nanning City, so it has a better financial environment.

3.2. Green City Water Sewage Treatme nt Design

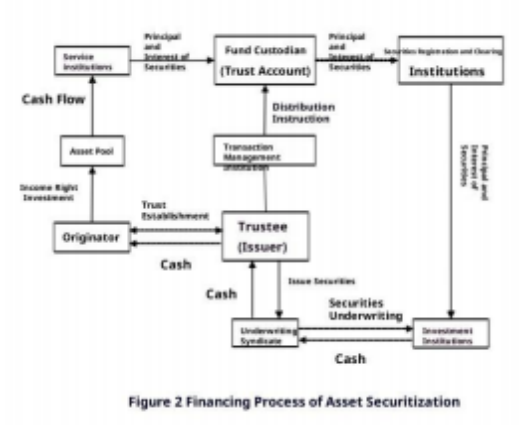

For the assumption of the sewage treatment plan for Greentown Water, w e can divide it into several parts. D iscuss based on the flow direction in Figure 2.

3.2.1 he original equity holder willactually sell the target proj ect to obtain funds

According to the analysis of the original equity holder, Greentown Wat er Company, which sewage treatment pr oject should be used for the separati on and structural securitization rest ructuring. The current target project of Greentown Water’s sewage treatmen t is mainly the predictability of sew age treatment fees, such as the right to charge sewage treatment fees.

3.2.2 The original equity holder will actually sell the target pro ject to obtain funds

SPV is the core of the entire tra nsaction structure. The purpose of it s establishment is to take over the a ssets sold by the initiators and isol ate them from bankruptcy. The SPV tha t established the project is a specia l company and a dedicated asset secur itization financing for the sewage tr eatment project. The SPV issues the asset pool of the project and is the n ominal initiator of the fund pool con struction. And SPV will sign an agree ment with Greentown Water to achieve bankruptcy isolation and ensure the i nterests of investors.

3.2.3 Establish a guarantor

The guarantor needs to have a hig h reputation because the purpose of e stablishing a guarantor i s to guarant ee the funds and ensure that the fund s can be repaid on time. If there are problems with the recovery of the fu nds, the guarantor will be held respo nsible to transfer the risk of the fu nds not being repaid. We recommend us ing local banks here. Firstly, banks have a high reputation. Secondly, usi ng local banks is beneficial for driv ing the economy and promoting local d evelopment. Moreover, using local ban ks can better understand market infor mation and facilitate activities.

3.2.4 Establish a management party

The management party needs to man age the asset pool and settle debts. After the successful issuance of the sewage treatment asset securitization product, SPV will hire professionals from professional institutions to op erate and manage the sewage treatment asset pool, collect the cash flow of the asset pool, pay it to investors after deducting various expenses, and pay the remaining cash flow after pa ying all principal and interest to th e initiator.

3.2.5 Credit rating agencies

Credit rating, as a social interm ediary service, evaluates various asp ects of sewage treatment and the cred it level, securities credit rating, a nd information disclosure of the actu al controller of the initiator, and makes the evaluation public, so that i nvestors can make corresponding inves tment decisions based on their invest ment methods, playing a key role in r aising funds. Due to the comprehensiv e evaluation conducted by Zhongchengx in Securities Evaluation Co., Ltd. du ring the company’s bond financing, th e issuer’s main credit rating is AA+, which means lower credit risk and re flects the strong performance of the project.

3.2.6 Investor

Investors are the holders of secu rities issued by asset securitization, generally composed of financial inst itutions and the public. Investors ho ld securities issued through asset se curitization and receive principal an d interest amounts upon maturity. Whe n investing in wastewater treatment a sset securitization, investors do not consider the assets of Greentown Wat er, but the future cash income from t he securitized wastewater treatment f ees.

3.3. Feasibility Analysis

3.3.1 policy analysis

The environmental protection indu stry plays a very important role in p romoting the transformation and upgra ding of China’s economic structure, i mproving social governance level, and promoting social fairness and justic e. National policies promote the deve lopment and upgrading of the sewage t reatment industry. The release of the “13th Five Year Plan for the Constru ction of Sewage Treatment and Reuse F acilities” has put forward higher req uirements for the construction of sew age treatment facilities, sewage trea tment capacity, sewage treatment stan dards, etc. in urban areas across the country, ushering in new development opportunities for the sewage treatme nt industry. Meanwhile, with the incr easingly severe environmental protect ion situation, the requirements for s ewage treatment standards are constan tly increasing. Therefore, the sewage treatment industry is also facing ur gent requirements for upgrading and t ransformation. At present, the compan y’s sewage treatment business is main ly distributed in the jurisdiction of Nanning City and its five counties. Under the current policy promotion, t he company’s sewage treatment busines s will also benefit from strong suppo rt from national policies.

3.3.2 Project Selection

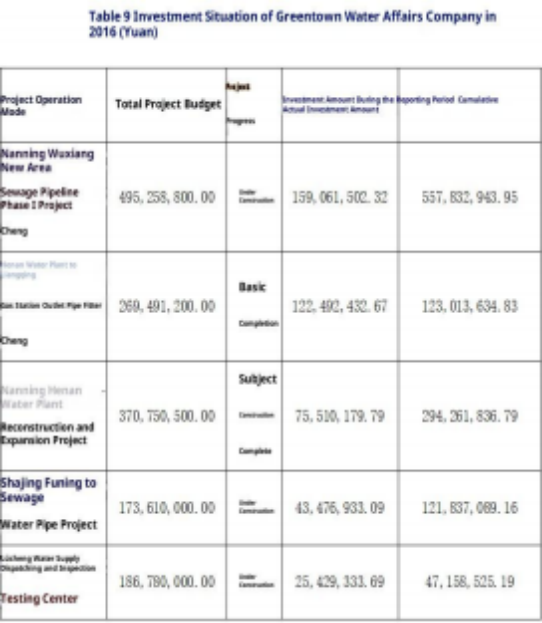

From the perspective of the compa ny, Table 9 shows that Greentown Wate r Company still has many ongoing proj ects, which reflects its high financi al pressure and also indicates that t here are many project options availab le for asset securitization.

Data source : Annual Report of Gua ngxi Greentown Water Co., Ltd. for 20 16

- Existing problems and suggestions

4.1. Existing problems

4.1.1 Cost growth risk

To cope with the continuously gro wing demand for water and sewage trea tment, as well as to adapt to the inc reasingly strict regulatory standards of the environmental protection indu stry by the country, the company need s to increase investment in the const ruction and renovation of water suppl y and sewage treatment facilities. Th e expansion of construction scale and the upgrading and renovation of faci lities and equipment may result in ti ght funding requirements for the comp any, as well as increased costs due t o the conversion of ongoing projects to fixed assets, financial expenses, and operational costs.

4.1.2 The price of sewage treatment

is lower than the marginal cos t

The target projects of sewage tre atment basically refer to sewage trea tment fees. Currently, in China, the pricing of sewage treatment plants is generally set within the range stipu lated by the government. The sewage t reatment fees in our country need to be affordable for individuals, so the prices are relatively low. So it is necessary to establish a reasonable p rice formation mechanism to give inve stors confidence in the return of sew age treatment asset securitization, i n order to attract investors and be t he key to successfully issuing sewage treatment asset securitization.

4.1.3 The operational efficiency of

sewage treatment plants is rel atively low

The asset securitization of sewag e treatment plants is the issuance of

asset-backed securities based on the sewage treatment plant as the underl ying asset. The operational efficienc y of sewage treatment plants, as a fu ndamental factor, will directly affec t the credit rating of asset-backed s ecurities, thereby affecting the issu ance cost, efficiency, and even the f inal success or failure of the securi ties. In our country, operators of se wage treatment plants believe that as long as they invest more in building sewage treatment plants and graduall y accumulate, they can ultimately obt ain more funds. Valuing investment in

construction but lacking confidence in the operation and management of se wage treatment has led to a considera ble number of sewage treatment plants

being operated and managed in a back ward manner, resulting in low economi c benefits. As a result, many potenti al sewage treatment plant projects ma y be unable to be securitized due to low credit ratings.

4.1.4 Lack of sound laws and related talents

Securitization financing often re lies on large-scale underlying assets to achieve the goal of reducing cost s, which determines that the successf ul operation of securitization cannot be separated from the participation of large-scale investors. Currently, investors in our country tend to pref er investing in well-developed insura nce institutions or securities funds with clear investment directions, res ulting in a lack of primary investmen t entities for asset-backed securitie s. In the market of asset securitizat ion financing, intermediary instituti ons such as credit rating agencies or custodian banks that do not have the talent to understand asset securitiz ation financing can lead to many prob lems over time and make investors que stion the feasibility of asset securi tization.

4.2. suggestion

4.2.1 Control costs and expenses fro

m both internal and external p erspectives

Firstly, the cost of sewage treat ment needs to be improved. The cost o f sewage treatment fees is partly con tributed by the government’s finances, and then partly paid by consumers. I n areas with a larger population, the more sewage is generated, and the hi gher the sewage treatment fees requir ed. In areas with a smaller populatio n and lower water consumption, the le ss sewage is generated. So dividing t he sewage treatment fees into local a reas and increasing them in densely p opulated areas is not only due to the increase in sewage treatment costs, but also to alert people to save wate r. The second is to save costs. Adjus t the internal structure of the sewag e treatment plant, recover some of th e wasted funds, strive to maximize th e use of funds, develop sewage treatm ent technology, improve the efficienc y of sewage treatment, and ensure tha t funds are used well and not wasted.

4.2.2 Improve relevant laws and regu lations

Because the development of asset securitization financing in China is still in its early stages, many diffe rent problems will be found in practi ce. Overall, asset securitization lac ks strong rules and regulations, as w ell as provisions for supervision and management. This increases the risk of asset securitization financing in the market, so it is necessary to str engthen the regulation of arbitrage s pace. Although there is supervision f rom relevant departments, the intensi ty is not strong and the punishment i s relatively light, which cannot achi eve a deterrent effect. So it is nece ssary for relevant departments to str engthen regulatory systems and improv e relevant laws and regulations. And it is necessary to establish and impr ove relevant institutions in asset se curitization [20].

4.2.3 cultivate talents

To cultivate professional talents in asset securitization and environm ental protection enterprises, includi ng finance and economics, law, projec t engineering management, and other a spects. Only with different talents c an we conduct a preliminary assessmen t of the underlying assets during ass et securitization, determine whether it is suitable for asset securitizati on financing, and further integrate a

sset securitization with environmenta l protection enterprises, making it m ore specialized.

- Summary

Water is the source of life, so w ater management is irreplaceable. Aft er using water, sewage will naturally be generated, and sewage treatment i s a top priority for sustainable deve lopment in China. The capital cost of sewage treatment has always been a w eakness in the sewage treatment indus try. Currently, sewage treatment requ ires the construction of sewage treat ment plants and the collection of sew age for treatment. This also leads to high costs and low returns on invest ment for sewage treatment. So the fun - ding gap in the sewage treatment indu stry has always been significant. By utilizing asset securitization as a f inancing method, sewage treatment com pan ies can gradually activate themsel ves with future cash flows, without r elying on the government and banks an ymore. This reduces the financial pre ssure on both parties and achieves a win-win situation.

- In order to smoothly carry out as set securitization of sewage treatmen t, it is necessary to improve China’s asset securities market, perfect law s, regulations, and regulatory method s, and prevent those who engage in se lf theft. And by combining internal a nd external factors, suitable sewage treatment fee policies can be made ac cording to local conditions to reduce sewage treatment costs.

References

[1] Hong Yanrong. Institutional D esign and Guarantee of Liquidity for Asset Securitization Products [J]. Se curities Market Herald, 2008, (3) : 15 -23

[2]Wang Baoyue. Research on Asset Securitization Risk [D]. Beijing. Gr aduate School of Chinese Academy of S ocial Sciences, 2009.

[3]Wang Yandong. Research on the Bankruptcy Remote Mechanism of Asset Securitization [D]. Inner Mongolia. I nner Mongolia University, 2010.

[4]He Kai. Research on Accounting Recognition and Measurement Models o f Asset Securitization [D]. Anhui. An hui University, 2010.

[5]Na Mingyang. Research on the R elationship between Asset Securitizat ion and Financial Development and Financial Stability [D]. Jilin. Jilin Un iversity, 2011.

[6]Zheng Caiqin. Research on the Risk Isolation Mechanism of Asset Sec uritization in China [D]. Nanjing. Na njing University, 2012.

[7]Liu Qi. Forest Tenure Mortgage Loans : The Status Quo of Banks’ Relu ctance to Lend and the Securitization Model Research [J]. Issues in Agricu ltural Economy, 2013, 5 : 70-76.

[8]Liu Zhongjie. Research on the Legal Regulation of Financial Lease S ecuritization [D]. Chongqing. Southwe st University of Political Science an d Law, 2014.

[9]Lin Hua ; Ge Qianda ; Huang Chan gqing. Tax Treatment and Issues of As set Securitization [J]. Financial Res earch, 2015, 11 : 10-16.

[10]Dai Yuzan. The Practical Dema nd and Restricting Factors of Commerc ial Bank Non-performing Asset Securit ization [J]. Contemporary Economic Ma nagement, 2016, 38 (7) : 79-83.

[11]Shen Zhaohui. The Fragility o f the Legal Structure of Enterprise A sset Securitization [J]. Tsinghua Uni versity Law Journal, 2017, (06) : 61-7 4.

[12]Li Bo. 2017 China Asset Secur itization Development Report [M]. Bei jing : China Central Depository & Clea ring Co., Ltd., 2018 : 5-7.

[13]Mi Chao. Stress Analysis of T hermal Shaft and Flow Field Character istics Research of Sludge Treatment R otary Disc Dryer [D]. Baolanzhou. Tia nhua Chemical Machinery and Automatio n Research & Design Institute Co., Lt d., 2017.

[14]Liu Fu. Guangxi Green City Wa ter Co., Ltd. Listed on the Shanghai Stock Exchange [EB/OL]. Nanning NewsNetwork, 2018.

[15]Guangxi Green City Water Co., Ltd. 2016 Annual Report [M]. Guangxi, 2017 : 24-26.

[16]Shen Yunhua. Case Analysis of Nanjing Public Utilities Holding Wat er Facility Revenue Rights Asset Secu ritization [D]. Guangdong. Guangdong University, 2015.

[17]He Chengsheng. F City Rail Tr ansit Construction Asset Securitizati on Financing Scheme Design [D]. Guang dong. South China University of Techn ology. 2015.

[18]Qian Xuyun. Design of Asset S ecuritization Financing Model for X C o., Ltd. [D]. Beijing. Beijing Techno logy and Business University. 2016.

[19]Shao Yongfu. A Brief Discussi on on the Current Situation, Problems, and Solutions of China’s Environment al Protection Industry Development[J]. Economist, 2017, (5) : 81-82.

[20]Ouyang Mijian. Beware of Risk s in Asset Securitization [N]. 21st C entury Business Herald, 2018 -2 -28 (004).

[21]Zhao Lu. Research on XYZ Grou p Asset Securitization Risk Managemen t. [D]. Tianjin. Tianjin University o f Commerce. 2014.