Liang Gang1 ,Wang Feng2 ,WangZhemg3

(1 ,Haikou EconomicCollege,Haikou,Hainan,571132

(2 ,Guangxi University of Finance and Economics,Guangxi Zhuang Autonomous Region,530001

(3 ,Postdoctoral Research Station of the Institute of

abstract:With the progress of new era and rapid development of economy,the consumption I we bring the environment pollution is becoming more and more serious,so people pursuit the sustainable development of ecological pollution and economy is more and more obvious. Financial industry is a rising industry,new and green finance represents a new trend and new direction of the development of the financial industry in our country,but also a great challenge for our country,along with the further acceleration of financial reform,China on June 14,2017,the state executive meeting to determine in guangdong,zhejiang,jiangxi,guizhou,xinjiang and other five provinces (area) the construction of green financial reform and innovation experimental zone,promote the green transformation and upgrading. In this paper,in order to in the process of the concept of green finance in guangdong province to carry out development of the Chinese government on the Paris agreement if bearing as a starting point,in guangzhou to implement green financial will bring what kind of effect analysis,and put forward the problems existing in the practice process of green finance and some advice for promoting the development of the green finance better.

Key words: Green finance; Carbon green gold; Pollution sources; Effect analysis

I 、The background and current status of green finance in China.

( I ) The background and concept of green finance in China

1 . The background of green finance in China

In the 1990s,the publication of ‘Our Common Future’ sparked a green wave,leading to increasing attention on environmental protection issues.Although our country recognized environmental issues early on and has been focusing on green finance for over a decade,it was not until September 2015 that green finance was formally introduced for the first time.The second mention was in the recommendations of the 13th Five-Year Plan,and green finance was again included in the government work report during the two sessions in 2017.This clearly shows that our country places greater emphasis on green finance.

On September 3,2016,our country offici ally became the 23rd contracting party to c omplete the approval of the Paris Agreeme nt.The Paris Agreement is an agreement tha t sets requirements and constraints for me mber countries regarding future climate cha nge.The agreement requires all countries to strengthen their efforts to address the thr eats posed by climate change,ensuring that global average temperature increases are ke pt well below 2 degrees Celsius,and striving to limit the increase to 1.5 degrees Celsiu s. In the second half of the 21st century,all countries around the world will make every effort to control the emission of gases

that cause the greenhouse effect and achi eve net-zero emissions.According to this require ment,all countries will participate in global clim ate change actions in a voluntary and self-cont ributing manner.As pioneers,developed countries will continue to set an example by leading in reducing emissions and providing stronger sup port to developing countries in terms of fundi

ng,technology,and capacity building, helping the m mitigate the difficulties caused by environme ntal pollution and adapt to climate changes.

Developing green finance is aimed at sust ainable development in our country and fulfilli ng our obligations as a signatory to the Paris Agreement.Considering our national conditions as a developing country,we have formulated a series of systems and policies that promote en vironmental protection and energy conservation on a voluntary basis,and green finance is a f undamental policy introduced by our country.

2.The concept of green finance

Green,as one of the five major concepts o f human development,is a way to resolve the conflict between humans and ecology,the found ation for people’s pursuit of a better life,and a lso a transformation in the economic sector. De veloping green finance is an indispensable part of this process.

Green finance has two meanings: first,it re fers to economic policies that affect financial a ctivities and environmental protection; second,it refers to the long-term development of financ ial activities within the financial industry.Based on this,China regards environmental protection as a fundamental policy,and when making inve stment and financing decisions related to energ y saving,clean energy,and green transportation,o ne must carefully consider potential environme ntal and social factors.The status of environme ntal remediation and the cost of environmental

protection should be included as regular perfo rmance evaluation indicators for banks.At any t ime,financial operations should not conflict wit h the protection and management of the ecol ogical environment,and should provide socioeco nomic resources to promote sustainable develo pment in both social and financial aspects.

(II)The current state of green finance i n China

In April 2017,the ‘2017 China Finance Soci ety Annual Conference and China Green Financ e Summit’ was held in Beijing.The conference e mphasized that it would promote the develop ment of green finance along the Belt and Roa d Initiative.

As early as the beginning of 1981,during t he period of adjusting the national economy,th e State Council proposed to strengthen environ mental protection work.Subsequently,the Central Committee issued the ‘Overall Plan for Ecologi cal Civilization System Reform’ to the Communi st Party of China. However,the first clear establi shment of the design goals for China’s green fi nancial system was in September 2015.In 2016, during the preparatory period for the G20 sum mit,the Green Finance Group,after detailed discussions,passed the ‘G20 Green Finance Synthesi s Report’ .On June 14,2017,at a State Council e xecutive meeting,Zhejiang,Jiangxi,Guangdong,Guiz hou,and Xinjiang five provinces (regions) were i dentified as green finance reform and innovati on pilot zones.

China’s green finance is currently in a nascent stage.Some financial institutions have introduced a series of financial products,such as ‘green loans,’ ‘green securities,’ and ‘green insurance,’ which benefit environmentally friendly enterprises or companies in promoting green initiatives.They also launch related financial derivatives,such as carbon emission rights and water discharge rights. Local governments and enterprises in our country are leveraging their own advantages to vigorously develop green finance.

( III ) The necessity of promoting green finance

General Secretary Xi Jinping emphasized at a meeting on financial security that financial security is a core component of national security and a crucial foundation for stabilizing the economy and achieving healthy,sustainable development.The development of financial security is a challenging,strategic,and fundamental matter for the comprehensive development of China’s socio-economic landscape.

Since the establishment of the People’s Bank of China’s Green Finance Research Group in 2015,followed by the formation of the G20 Green Finance Study Group in 2016,and then the approval of the ‘Guiding Opinions on the Construction of a Green Financial System’ and its implementation at the 27th Reform Committee meeting,as well as the green fiscal expenditure situation in five provinces (regions) in 2017,these actions have been exploring and establishing green finance experiences,and more importantly,promoting economic green transformation and facilitating international cooperation.

1.Promote supply-side structural reform

Since China’s reform and opening-up,its economy has developed rapidly.In 2015,China’s GDP reached 68.90521 trillion yuan. During the process of economic development,China has faced pressures of high production capacity,high inventory,and low efficiency.The Central Economic Work Conference proposed that in 2016,green finance should be developed to achieve the goals of reducing production capacity and inventory,effectively solving environmental pollution problems,thus realizing the five major development concepts and promoting supply-side structural reform.

2.Contributes to enhancing the financial sector’s management of financial risks.

Risks have also harmed the interests of gr een investment and financing entities,including financial institutions and enterprises. However, Pr esident Xi Jinping has proposed that when the re is a conflict between the environment and the economy,we would rather have green mou ntains and clear waters than a mountain of go ld and silver. Developing green finance tests the risk management capabilities of financial regulatory authorities.

II 、Guangzhou’s advantages and experience s in promoting green finance

Guangzhou,as the only first-tier city green finance innovation pilot,explores various forms of green finance development,focusing on the innovative development of financial services a nd products such as ‘green funds’,’green bonds ‘,’green loans’,and ‘green insurance’.It also cauti ously and steadily advances the innovation of carbon financial products,closely linking emissio n rights,water usage rights,and the rapid devel opment of strategic leading industries such as new energy vehicles.This aims to create a new development model where the green financial market and economic growth mutually promo te each other.Since June 23,2017,Huadu District of Guangzhou has become the only core gree n industry and financial coordination innovation experimental demonstration zone in southern China,thus forming a platform for cooperation and development in the Guangdong-Hong Kong -Macao Greater Bay Area,promoting the constr uction of the ‘Belt and Road’.

(I)The advantages of Guangzhou’s prom otion of green finance

1.Guangdong has a first-mover advantage in the carbon financial market.

Guangzhou,as the capital of Guangdong Pr ovince,has been supported by Guangdong’s dev elopment.The Guangdong carbon market starte d operating years ago,and the Guangzhou Carb on Emission Exchange became one of the seven national pilot programs in 2013. It has been

at the forefront of carbon financial innovation among the seven pilot carbon markets nationw

ide,providing various tools for Guangdong’s emission reduction enterprises and investment insti

tutions to participate in carbon market transactions.A total of 65 million tons of quotas have

been traded,with a total transaction amount of 1.5 billion yuan. It has become the first city pilot in the country to break the 1 billion yu an mark for total quota trading volume,ranking third globally in terms of carbon quota scale. In March 2018,the first domestic platform for new energy asset investment,financing,and trading was officially launched in the Guangzh ou Pilot Zone for Green Financial Reform and Innovation.The national carbon trading pilot exc hange,Guangzhou Carbon Emission Exchange,als o relocated to the green finance street in the pilot zone.One by one,financial institutions an d quasi-financial institutions have successively s ettled in the pilot zone,gradually highlighting t he agglomeration effect of green finance.

2.Guangzhou has successfully collaborated with major institutions in green financial services.

In terms of green credit: By December 20 17,Guangdong Industrial and Commercial Bank had issued loans totaling 36.6 billion yuan for green credit projects.Guangdong Huaxing Bank was approved to issue a total of 5 billion yua n in green financial bonds for green credit pro jects.In terms of green debt: In 2018,Guangzho u Bank issued the first tranche of 5 billion yuan in green financial bonds.In terms of green f unds: Huadu District,together with Guangzhou Financial Holdings,established the Guangdong G reen Finance Investment and Holding Group,an d jointly set up an investment fund with Guan gdong Airport City Investment Company and C hina Railway Construction (Guangzhou) for the North Station New Town Investment and Const ruction Company,including the Guangzhou Nort h Station Fund and the Green and Low-Carbon Development Fund.Additionally, Deputy Secretar y of the Huadu District Committee,Cai Jian,stat ed that starting from 2017,the district’s finance has allocated no less than 1 billion yuan ann ually for five consecutive years as special fund s to support green development,significantly accelerating the implementation of green finance policies.

In January 2018,a cross-border financial co operation promotion event hosted by the Gua ngzhou Financial Bureau was held in Hong Kon g.Director Qiu Yitong stated that Guangzhou’s f inancial service functions have been continuous ly improving,with significant achievements in ke y projects aimed at creating specialized financi al zones. For example,Yuexiu District has establi shed the country’s first folk finance zone, Nans ha District is focusing on building a cross-bord er financial service zone leveraging the free tr ade zone,Zengcheng District is prioritizing the d evelopment of financial services for small and medium-sized enterprises,Haizhu District is deve loping a venture capital town,and Liwan District is aiming to serve the entire city by building the Baietu Tan industrial and entrepreneurshi p service zone,among others.

3.Guangzhou has successfully explored the development of green credit.

Guangzhou not only focuses on developing carbon financial markets but also remains vigi lant in developing green financial services such as ‘green credit’ and ‘green bonds’.The district government actively collaborates with social c apital,mobilizes social capital,expands the devel opment of green insurance,improves the enviro nmental rights trading market,and diversifies fi nancing channels.

From 2017 to March 2018,Guangzhou held a series of product financial connect meetings, resulting in a total intention financing amount exceeding 500 billion yuan between banks and enterprises. By the end of 2017,the loan balan ce of banking institutions in the Guangzhou ar ea was 3.4 trillion yuan,an increase of 15.06% year-on-year,ranking first among major cities nationwide; the city saw the addition of 18 lis ted companies,with cumulative financing reachi ng 380 billion yuan; 116 new companies were added to the New Third Board,raising a total of 12.4 billion yuan; the total amount of bon ds issued by all types of enterprises in the cit y was 177.4 billion yuan.State-owned enterpris es reduced their financing costs by more than 4 billion yuan through capital markets.A natio nal-scale science and technology credit risk co mpensation fund pool was established,with credit amounts up to 7.684 billion yuan; brands s uch as the ‘Guangzhou Science and Technology Finance Roadshow Center’ and ‘Guangzhou New Third Board Enterprise Roadshow Center’ were launched,conducting various forms of science and technology finance product connect.The’Plan for Further Supporting the Real Economy Development through Insurance Industry’ was issued,actively guiding insurance funds towards the real economy.

(II)The practice of green finance in Gua ngzhou

In 2012,the Guangzhou Carbon Emission E xchange was established,which is a platform fo r the paid allocation and trading of carbon em ission quotas under the PPP model.At the sam e time,it has built a diversified mechanism for supplementing carbon emission quotas and pr ovided an all-encompassing financial service pla tform called ‘Guangzhuan Green Finance.’ This effectively integrates various financial service pl atforms such as “green loans”,“green bonds”,“g reen funds”,“equity trading”,“leasing finance”,an d “ABS”,creating a multi-level green financial p roduct system.

1.Guangzhou Carbon Exchange

Liu Xiaohong,Chairman of Guangzhou Exch ange and Guangzhou Carbon Exchange,pointed out at the Guangzhou Financial Industry Promo tion Conference that as the state-designated pl atform for voluntary emission reduction trading and carbon emission quota trading,Guangzhou Carbon Exchange has actively played the role of a third-party public trading service platfor m since its establishment,driving Guangzhou’s d evelopment of low-carbon living and environme ntal protection industries through carbon emiss ion rights trading.Currently,the development of China’s green finance harbors immense investm ent and financing opportunities,and the develo pment of Guangzhou Carbon Exchange has bro ught many experiences to Guangzhou’s innovati on in green finance. It has implemented multipl e financing projects in various green financial s ervice projects such as carbon financial ABS,car bon emission quota pledge financing,carbon em ission rights forward trading,and repurchase fin ancing.

2.Guangdong Province Green Finance Inve stment Holding Group Co.,Ltd.

Guangdong Green Finance Investment Hold ing Group Co., Ltd.,adhering to the business phi losophy of development,innovation,talent,brand, service,and risk,focuses on the Guangzhou and South China market,actively expands into econ omically developed regions within the country, and steadily extends into moderately develope d economic areas,aiming to form a financial h olding group with strong financing service capa bilities and a variety of investment products w ithin the South China region.On June 23,2017,b ased on serving the green finance developmen t of the entire city,Guangdong Green Finance I nvestment Holding Group Co., Ltd.,which aims t o become a comprehensive and systematic gre en finance investment holding group,was awarded the title of newly established financial instit ution and platform by provincial and municipal leaders at the Sixth China (Guangzhou) Intern ational Financial Expo.The company signed two green fund projects,the Guangzhou North Stat ion Fund and the Guangzhou Huadu District Ai rport Industry Investment Fund,worth a total of 3.1 billion yuan,with Guangdong Airport City Investment Company and China Railway Constr uction (Guangzhou) Beijiao New Town Investment and Construction Company,becoming one of the highlights of the expo.

3.Guangzhou Green Finance Street

Guangzhou Green Finance Street is the sta rting area for Guangzhou’s green finance refor m and innovation,located on Yingbin Avenue in Huadu District,Guangzhou.It is an integrated fi nancial cluster area that combines an innovatio n center,service center,and research center alo ng a 600-meter street. It aims to achieve break throughs in traditional businesses and industrie s by attracting various research institutes,consu lting firms,etc.,to provide comprehensive listing guidance or investment and financing consulti ng services for key projects,key industries,and key enterprises. [29]

III、Analysis of the Effectiveness of Promoting Green Finance in Guangzhou

(I)Environmental air quality index

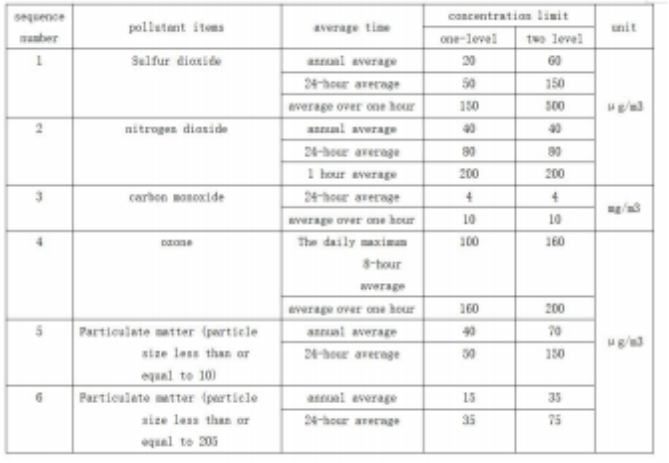

To implement China’s Environmental Prote ction Law and Pollution Prevention and Control Law,and to safeguard human health,the Ministry of Ecology and Environment of the People’s Republic of China has designated the ‘Ambien t Air Quality Standards’ (GB3095—2012) as the basis for improving environmental quality in China.The basic items of ambient air pollutants and their concentration limits set by the stat are shown in Table 1.

Table 1 Basic Project Concentration Limits for Ambient Air Pollutants

(II)Analysis of main indicators of ambient air quality in Guangzhou

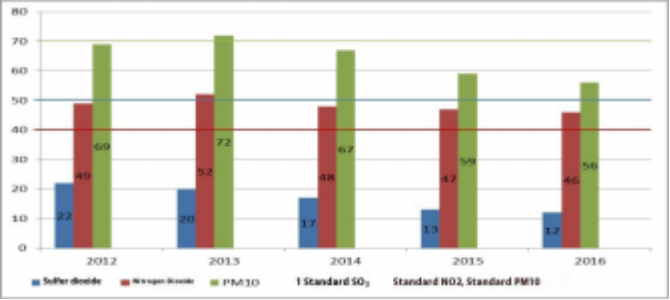

Figure 2: Changes in Guangzhou’s indicators of SO2,NO2,and PM10 from 2012 to 2016

From Figure 2,it can be seen that in 2016,the average concentration of sulfur dioxide (SO2) in Guangzhou’s ambient air was 12 micrograms per cubic meter,meeting the Ambient Air Quality Standards (standard limit of 50 micrograms per cubic meter),which represents a decrease of 7.7% compared to the previous year.From 2012 to 2016,the concentration of sulfur dioxide showed a downward trend,with a reduction of 45.5% from 2012 to 2016.

From Figure 2,it can be seen that the average concentration of NO2 in Guangzhou’s ambient air in 2016 was 46 micrograms per cubic meter,a decrease of 2.13% compared to 2015.From 2012 to 2016,the concentration of nitrogen dioxide showed an unstable downward trend,while SO2 decreased by 6.12% in 2016 compared to 2012,but still exceeded the standard limit.

From Figure 2,it can be seen that the average concentration of PM10 in Guangzhou’s ambient air in 2016 was 56 micrograms per cubic meter,meeting the ‘Air Quality Index’ standard limit of 70 micrograms per cubic meter,which represents a decrease of 5.08% compared to the previous year.Over the past five years,the concentration of PM10 has shown a fluctuating downward trend,with a reduction of 18.8% from 2012 to 2016.

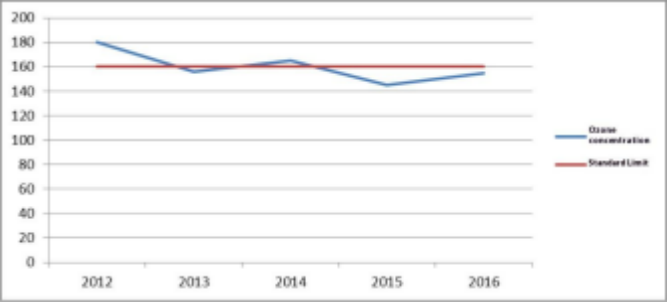

Figure 3: Ozone 90th percentile concentration from 2012 to 2016

From Figure 3,it can be seen that in 2016,the 90th percentile concentration of ozone in Guangzhou’s atmosphere was 155 micrograms per cubic meter,which was only 5 micrograms per cubic meter lower than the ‘Ambient Air Quality Standards’ (standard limit: 160 micrograms per cubic meter) on average,but it increased by 6.9% compared to 2015.During the period from 2012 to 2016,the 90th percentile concentration of ozone fluctuated and showed a downward trend,with the 90th percentile concentration of ozone in 2016 decreasing by 14.8% compared to 2012.

Figure 4: Annual average PM2.5 from 2012 to 2016

As shown in the above figure: In 2016,the average concentration of PM2.5 in Guangzhou ‘s ambient air was 36 micrograms per cubic m eter,which did not meet the Ambient Air Quali ty Standards (standard limit: 35 micrograms pe r cubic meter),representing a decrease of 7.7% compared to the previous year.

However,from 2012 to 2016,the annual av erage concentration of PM2.5 showed an unsta ble downward trend,decreasing by 29.4% in 20 16 compared to 2012,and has gradually approa ched the standard limit.In the future,it will def initely be lower than the standard limit.。

According to national requirements,the eva luation of Guangzhou’s air quality is based on the review of five indicators: SO2, NO2, PM10, PM2.5,and O3.Figure 1 shows the data changes of sulfur dioxide,nitrogen dioxide,and PM10 fro m 2012 to 2016. Figures 2 and 3 show the cha nges in ozone and PM2.5 from 2012 to 2016. F rom the recent air quality indicators,it can be seen that Guangzhou’s air quality is getting be tter and gradually meeting national standards.

(III)The main sources of air pollution i n Guangzhou

People always group Beijing,Shanghai,and Guangzhou together,indicating how developed Guangzhou’s economic development is. Its econ omic growth rate has always maintained a ste ady upward trend. From 2001 to 2009,Guangzh ou’s GDP increased nearly fourfold from 268.5 76 billion yuan to 911.276 billion yuan,with an average annual growth rate of about 16.5%; meanwhile,the number of motor vehicles in th e city increased by nearly 42%,from 1.4246 mil lion to 2.0246 million,which is a staggering fig ure.The scale of industry continues to expand,a nd the demand for motor vehicle travel keeps rising,putting immense pressure on Guangzhou to improve air quality and the ecological envi ronment.

1.Sources of inhalable particulate matter pollution

Firstly,because most people basically use s toves and boilers for cooking and heating with out scientifically treating the smoke,but instead releasing it arbitrarily,the air quality once decl ined; secondly,many places burn garbage or cr op residues in the open air,which allows more inhalable particles to enter the atmosphere,in creasing the likelihood of people falling ill.Addi tionally,this includes road dust in cities,causing secondary air pollution.

- industrial pollution

Industrial pollution includes pollutants emit ted from chemical plants,thermal power plants, steel mills,and cement factories. In such large f actories,purifying emissions is also a significant project.Many factories cut corners,releasing un filtered,pungent organic or inorganic toxic gase s into the atmosphere.Chemical fiber factories discharge liquid or solid toxic pollutants,as well as various mineral wastewater and metal dust, causing air pollution and even damaging the li ves of downstream residents.To save costs,fact ories not only harm themselves but also other s,leading to the expansion of industrial pollutio n and reduced efficiency in emission reduction. - automobile exhaust emissions

The number of motor vehicles in Guangzh ou increased from 1 million in 2007 to over 2.

5 million in 2013,with a growth rate of 1.5 ti mes over six years.As a result,vehicle emissions have long been the primary source of air poll ution in Guangzhou.The type of air pollution in Guangzhou has shifted from coal smoke type in the past to the current motor vehicle exha ust type; most of the CO and about half of t he NOX in the air come from vehicle emission s.When the engine is in a rich fuel state,CO e missions are at their highest. Modern cities are densely packed with high-rise buildings and narrow roads,leading to frequent low-speed drivi ng and traffic congestion.Therefore,air pollution is more severe in congested areas,resulting in a stable layer of pollution in the urban airspace. In densely populated and heavily trafficked areas,it is not just a serious environmental poll ution issue but also relates to the health and quality of life of residents.

(IV)Guangzhou’s main measures to address pollution

1.Strengthen planning guidance,enhance environmental protection awareness

On October 26,2016,the Standing Committ ee of the Guangzhou Municipal People’s Congr ess heard and deliberated on the report of th e ‘Guangzhou City Environmental Master Plan’ for 2014-2030,marking the launch of the ‘Guan gzhou City Environmental Master Plan’ for 201 4-2030,participating in the city-wide ‘diverse an d integrated’ work.The ‘Guangzhou Environment al Protection 13th Five-Year Plan’ was issued a nd implemented,and the revision work of the city’s ecological strict control areas was carried out.The ‘Final Evaluation Report’,’Research Rep ort on the Policy System of Guangzhou Ecologi cal Compensation Mechanism’,and ‘Research Re port on the Supervision and Management Mec hanism and Supporting Policies of Guangzhou Ecological Protection Red Lines’ were complete d.The relevant research reports on the environ mental competitiveness of Guangzhou in 2014 and the environmental competitiveness of vario us districts,as well as the ‘Research Report on

the Index System of Guangzhou Ecological Civili zation’,were also completed.

2.Rational use of energy

The greatest advantage of using alternativ e fuels such as natural gas is that it can effec tively reduce emissions of carbon monoxide,NO X,and particulate matter,achieving reductions of 80% to 85% for carbon monoxide and NOX,a nd also extending the engine’s service life; dev eloping electric vehicles can effectively eliminat e or significantly reduce emissions of carbon monoxide,NOX,HC,and particulate matter.

3.Increase investment in air pollution pre vention and control funds.

In 2015,the Guangzhou Municipal Bureau of Environmental Protection and the Guangzho u Municipal Financial Bureau jointly issued the ‘Funding Reward Measures for the Rectificatio n of High-Pollution Fuel Boilers,’ which promot ed the elimination of high-pollution fuel boilers through economic incentives and encouraged the use of clean energy.In 2016,Guangzhou enc ouraged public supervision and enforcement by implementing a reward system for reporting v iolations.Seven cases of cooperation in using cl ean energy were rewarded,totaling 22,500 yua n.

4.Science improves road traffic conditions

To address traffic congestion and reduce e xhaust emissions,Guangzhou released its third phase of urban rail transit construction plan in 2017.This plan includes bidding for seven sub way lines and the construction of eleven tramlines,creating an extensive network that spans the entire city.Such planning avoids additional exhaust emissions from motor vehicles due to traffic issues,thus preventing environmental po llution.Furthermore,Guangzhou has already begu n research on its transportation strategy plan f

or 2040,proposing a strategic development blue print to ‘build a transportation system that ma tches top global cities by 2040.

(V)Guangzhou’s green finance initiatives

1.The formulation of green finance policie

In June 2011,the People’s Government of Guangzhou issued the ‘Construction Plan for th e Regional Financial Center of Guangzhou from 2011 to 2020’ to accelerate the construction of a national green financial center,promote so cial and economic transformation,deepen financ ial system reform and innovation,and promote the harmonious development of green finance and the socio-economic development.In 2016,th e People’s Government of Guangzhou issued th e ‘Action Plan for the Modern Financial Service System of Guangzhou from 2016 to 2018’ an d the ‘Thirteenth Five-Year Plan for the Develo pment of the Financial Industry of Guangzhou from 2016 to 2020′,among others,which made low-carbon finance and green finance core wor k plans.On June 23,2017,with approval,the People’ s Bank of China,along with seven other ministr ies,jointly issued the ‘Overall Plan’ for the esta blishment of the Guangdong Province Guangzhou City Green Finance Reform and Innovation Pilot Zone.At the same time,both Guangdong P rovince and Guangzhou City will explore the c onstruction of Guangzhou as a green finance c enter city as part of their government work re ports.

2.Green financial institutions are being es tablished.

With the establishment of ‘Dongfeng Nissa n’ and Guangzhou New Airport in Huadu Distri ct,Guangzhou,this advanced manufacturing area has gained even more momentum.The annual growth rate of Huadu District’s total industrial output value has consistently remained in do uble digits. In 2017,the total industrial output v alue of large-scale enterprises in the district ex ceeded 2.344853 trillion yuan.The automotive i ndustry,led by Dongfeng Motor,accounted for 7 1.8% of the district’s total industrial output val ue in 2015.

The construction of the Guangzhou High-T ech Airport and the Comprehensive Bonded Zo ne at the airport has introduced high-level ind ustries such as cross-border e-commerce,moder n logistics,aircraft parts maintenance,and manuf acturing to Huadu District.This provides a direc tion for expanding the scale of industries and enhancing industry competitiveness in Guangzh ou.

3 .Innovation in green financial products

In terms of green credit development: Gu angzhou Bank had approximately 10 billion yua n in green loans in 2017,mainly focusing on waste treatment and water management.Currentl

y,the scale accounts for 3%,with plans to increase to at least 10% by 2020,primarily investing

in green credit. Regarding green bonds: Guangdong Province issued green bonds accounting f

or 47.5% of the total issuance volume in 2017,ranking first among all special bonds,and the fi

rst bond issued in 2018 was also a green bond.The primary function of green bonds is to as

sist companies needing energy-saving and emission-reduction technology upgrades,encouraging

the use of clean energy and urban greening.In the field of green insurance: From 201 3 to the end of 2016,a total of 186 investmen ts in environmental pollution liability insurance were made,covering 339 enterprises (instance s),with the number of insured companies acco unting for about 45% of the province,and the total premium amounting to 138.35 million yu an,with a guarantee amount of 688 million yu an.Guangzhou has also established a credit sys tem to help financial institutions better assess the operational status of enterprises,facilitating the smoother development of green finance.

4.The promotion intensity of green finance

Guangzhou organized a special forum on g reen finance at the sixth Financial Exchange C onference,launching China’s first ‘China Carbon Market 100 Index’ to evaluate the green devel opment capabilities of enterprises under carbo n trading control.This index uses listed compan ies from industries included in the national carbon market as samples to assess enterprises w ith excellent green development,providing refer ences for investors to make green investments and encouraging enterprises participating in C hina’s carbon trading to disclose more compre hensive information and enhance their green d evelopment capabilities.Guangzhou will leverage platforms such as the China (Guangzhou) Inte rnational Finance Expo and the International Fi nance Forum (IFF) to strengthen external excha nges on green finance,attracting financial institutions from abroad,especially from Hong Kong and Macau,to set up branches and conduct in novative businesses in the pilot zone.A comple te mechanism for the transformation and upgr ading of green financial services and risk preve ntion and solutions for green finance will be e stablished.

IV、The issues existing in the development of green finance in Guangzhou

(I)The economic characteristics of the a irport area have initially taken shape,but ther e is a lack of uniformity in the industrial hier archy.

With the rapid development of globalizatio n and the informatization of the economy,the characteristics of airport economy have initially formed,centered around modern large internat ional hub airports. Platforms such as Guangzhou Airport Comprehensive Bonded Zone and High -tech Airport Industry Incubation Base have gat hered aircraft parts manufacturing and mainten ance,e-commerce (including cross-border e-commerce), LED optoelectronics,and new logistics in dustries in the ’12th Five-Year Plan’ period in Huadu Airport Economic Zone.They have already started air cargo port operations,bonded warehousing and processing,modern express business,and cross-border e-commerce.However,due toregional limitations,traditional industries such as clothing,flowers,and plastic products still exis

t,which lowers the overall economic level and leads to inconsistent phenomena,failing to fully

leverage the advantages of the airport area.

(II)After enterprises move into the Gre en Finance Street,their development momentu m is insufficient.

In the implementation process of green fi nance,its standards are mainly comprehensive a nd principled.Without clear rules and standards, green finance cannot fully reflect in corporate economic activities. Even large enterprises that closely interact with banking financial institutio ns cannot guarantee that all the green loans p rovided by banking financial institutions will be entirely used for building green industries.Mor eover,after enjoying initial policy benefits from entering the green finance street,some enterp rises may lack a clear future green developme nt direction,lack a comprehensive planning,and have insufficient motivation for sustainable gre en development.

(III)The information from the experime ntal zone is not shared,and the demonstration effect is not significant.

Green finance includes two major areas: environmental protection and finance. Effective and comprehensive information feedback is a prerequisite for making correct decisions,which determines the high difficulty of financial institutions’ environmental risk decisions. In the implementation process of green finance,financial institutions,various enterprises,and environment alptection departments need to coordinate andcooperate with each other,share informationpromptly,and develop corresponding financial service plans based on national financial policies,the impact on enterprise development,environ

mental standards,and other indicators. For example, Huadu District has formulated many green finance preferential policies,but they lack specificity and guidance,with insufficient capital investment and limited leverage effect,so it has not yet reached the level where it can use its im

plementation experience to promote green finance in other regions,resulting in an insignificant demonstration effect.From the perspective of financial institutio ns,there is insufficient promotion of green fina nce policies,and people’s understanding of gree n finance is still not clear.From the perspective of enterprises,companies may conceal or misr eport their environmental information to evade environmental protection responsibilities. Due t o these issues,during the implementation of gr een finance,there is inadequate and timely co mmunication of effective information among in stitutions and enterprises,leading to deviations from policy objectives in areas such as environmental assessment,performance evaluation,and fundraising.

(IV)Lack of promotion and oversight of gree n finance

Firstly,Guangzhou City’s Huadu District lack s an authoritative information release platform for promoting green finance,which fails to pro mptly publish relevant policies for the green fi nance reform and innovation pilot zone. It also cannot regularly or irregularly summarize the experiences and issues encountered during the development of the demonstration zone,makin g it less attractive to green financial resources in the Guangdong-Hong Kong-Macao Greater Bay Area and across the country.Additionally,ba nking financial institutions have not effectively supervised and investigated the environmental impact of enterprises,leading to a considerable degree of perfunctory behavior during loan a pplications,without a comprehensive review of environmental risks. High-energy-consuming and high-polluting enterprises can still obtain loan quotas even after falsifying information or cha nging financial service institutions. Listed compa nies engage in fraudulent listings and fail to di sclose company information in a timely manne r,while regulatory authorities cannot promptly address these fraudulent enterprises.

Secondly,financial regulatory agencies lack self-supervision and constraints,with serious viol ations and illegal operations significantly reduci ng the efficiency of green finance operations.T hese issues are related to the absence of a complete and effective regulatory system.The reg ulatory system has loopholes,the professional l evel of inspectors is limited,and there are insu fficient strict laws and regulations,which are th e main problems existing in the current financi al regulatory system.

V 、Put forward reasonable suggestions b ased on the current situation in Guangz hou .

(I)Vigorously develop and innovate gre en credit

In August 2016, seven ministries inc lu ding the People ‘ s Bank of China jointly i ssued the ‘Guiding Opinions ‘ on building a green financial system, proposing eight measures such as vigorously implementing green credit, promoting the securities ma rket to support green investment, and est ab lishing green development funds .As a r es ult, China has already established a high -level framework for a green financial sy stem . Guangdong Huaxing Bank, leveraging i ts own strengths, has been actively develo ping the green finance industry and can be considered a pioneer, laying a foundati on for future development .According to r eports, Guangdong Huaxing Bank has reser ved 34 green industry projects wit h a to tal loan amount exceeding 73 .27 billion y uan .The bank specially hired an independ ent third-party energy-saving consulting c ompany to conduct green certification an d follows the principles of control lability and sustainability in developing green credit .To date, Guangdong Huaxing Bank has

no non-performing green loans . It encourages banks and other financial institutions

to vigorously develop green credit and establish green credit mechanisms, boldly innovate in green finance, and steadily lau nch carbon options, carbon forwards, and o ther carbon financial derivatives .

(II)Strengthen support for financial

institutions to establish green initiative s.According to Guangdong Huaxing Ban k, in future business planning ,the bank ha s established an overall goal for green c redit development, mainly focusing on incr easing support for the research and deve lop ment of low-carbon, circular, and green products,gradually building the bank into a well-known green credit bank in Guang dong Province and even nationwide . In rec ent years, Guangdong Huaxing Bank has pl anned the issuance of its first 50 billion yuan green financial bond from the per spective of long-term development for bo th society ‘s economy and the financial se ctor itself.The green economy provides a mp le policy support for enterprise develo pment, achieving leapfrog progress in g ree n financial innovation .Apart from green c redit and green bonds, more encourage me nt should be given to financial institution s to incorporate green industry trusts,green funds, and green insurance into the en tire green cause . In the future,taking the issuance of green financial bonds as an opportunity, we will take practical actions to reduce financial risks to a control lab l e range, actively explore innovation in gre en financial services and products, pro mot e the development of the bank ‘ s green c a use ,facilitate energy conservation and e mission reduction, promote industrial trans formation and upgrading , and advance eco logical civilization construction .

(III)Accelerate the development of high technology and enhance competitive ness .

The industrial scale of Guangzhou ‘ s I nnovation Experimental Zone is small, lacki ng large enterprises capable of reaching national or international markets .The re ar e no highly competitive brand industries, no r are there large-scale production mod els . Low labor productivity remains the pri mary reason for job creation (as of the end of 2016, 7 . 43% of the city ‘ s workforc e was in the primary sector, 35 . 09% in th e secondary sector, and 57 .48% in the ter tia ry sector) .The service sector is also lac king in key pillars . Enhancing competitive n ess requires support from high techno log y, and the development of high techno log y will determine the future economic de velop ment and the scope of green financ e promotion in Guangzhou . It also re presents the direction of national social and e cono mic development, especially in areas s uc h as electronic engineering and pharma ce utical research and innovation .

Accelerating the development of high -tech industries, enhancing competitiveness, helps the experimental zone expand its i nd ustrial scale, develop industries and pro ducts with international competitiveness, e xplore new consumer sectors, strengthen c ooperation with cross-border enterprises, i mprove production efficiency, and boost th e long-term growth potential of enter pris es . Only then will companies entering Gua ngzhou ‘ s Green Finance Street play a lea ding role in driving the development of other experimental zones .

(IV)Increase publicity and regulatory efforts

- Increase publicity efforts

Currently, due to the lack of a green finance information release platform in Guangzhou,there is an issue with the tim ely reception of national policy informati on, or rather,there is no channel for the public to be informed about the progress of green finance development .The state has formulated a large number of fiscal and tax support policies in areas such as energy saving, resource comprehensive uti lization, renewable energy, and environment al protection, but enterprises are unable t o access the city ‘ s plans and guidelines, and they are also unfamiliar with green fi nance, making it difficult for them to effe ct ively cooperate with the city ‘ s overall development . - Strengthen regulatory efforts Due to the lack of an all-encompassi ng platform, regulatory authorities are una ble to oversee the implementation of the Guangzhou Green Finance Innovation Pil ot Zone as a whole or in detail.They can not monitor its various uses and releases of funds,technologies, and policies, leading to disruptions .This can result in the ent ire structure falling apart, causing unneces sary economic losses or even economic c haos .

- Strengthening regulatory efforts can enhance enterprises ‘ trust in Guangzhou , making them more willing to entrust thei r future to Guangzhou for planning and coordination . It can also boost people ‘s se nse of happiness in Guangzhou, making th em feel that Guangzhou is a city worth being proud of, not just by its residents but by the entire province and the natio n.

(V)Establish a financial risk preven tion mechanism

Financial products are the primary c ondition for dominating the financial mar ket . One of the key aspects of green fina ncial innovation is the innovation of fina ncial products,which means that financial products will continuously update and e volve . However,the financial derivatives cre ated during the process of financial in no vat ion often have characteristics of high leverage and high risk,thereby increasing the systemic financial vulnerability.The fin ancia l crisis that erupted in the United S tates in 2008 was due to the use of ov er ly complex financial derivatives, accum ul at ing a large amount of financial risk, lea ding to a global financial crisis . When Chi na promotes green financial pilot zones, it

must avoid and pay attention to the ris ks of financial derivative tools, not repeat

past mistakes, innovate regulatory system s, and establish an effective system to p r event financial risks .

VI 、Summarize

Green finance is a strategic priority that garners global attention, impacting a country I s economic and political develop ment, and is crucial to its national lifeline . China I s commitment to the Paris Agree m ent marks the first step in environmental protection, and a series of green policies and documents have been introduced to support green development, providing a s trong backing for the advancement of gr een finance . China is also creating green f inan ce pilot zones, experimenting with ne w financial projects using its own resour ces to promote the development of gree n finance and strive to build an economic and environmental superpower . Guangdo ng Province has leveraged its regional de velop ment status and existing experience to develop green finance and continuo u sly explore innovative green financial products and projects, contributing ideas and strategies for the country.Guangzhou I s green finance is becomi ng increasingly rich. Under the promotion of green finance, not only has air quality continuously improved, but it has also dev eloped together with green industries .Taki ng I rooted in the whole city, serving the entire province I as its starting point, it ac ce le rates the implementation of new indu stries and establishes a pilot zone that l eads the development of the entire city . By developing high-tech , it creates more i nd ustries and products with international competitiveness .This way,the advantages of Guangzhou I s pilot zone can be fully u ti lized, attracting more customers to lead the green development of other regions and even other pilot zones .

参考文献

[1] Ma Zhong,Liu Qingyang,Gu Xiaoming,Xu Xia ngbo,Chang Dunhu.’Developing Green Finance,P romoting Supply-Side Structural Reform’: 2016

[2] The Central Economic Work Conference pro posed five major tasks for 2016: reducing ove rcapacity,reducing inventory,etc.Securities Times, 2015

[3] Li Xiaoxi,Xia Guang,Cai Ning.’Green Finance and Sustainable Development’.Research Institut e of Development at Southwestern University of Finance and Economics,Environmental and E conomic Policy Research Center of the Ministr y of Environmental Protection,2015

[4] Zhang Peiguo.’Leading the Way: Contributin g More Guangdong Experiences to Green Fina ncial Reform and Innovation’ – Southern Netw ork,2017

[5] Xu Feng.’The Development and Innovation of Green Finance – Based on On-site Research

in Guangdong’: China Financial Publishing Ho use,2015

[6]DX Li,T Kang.Inspiration from Green Effect of South Korea’s Low-Carbon Economy Develo pment to China ,2012

[7] ose Salazar ,1998 ,Environmental Finance:Li nking Two World [R] .Presented at a Worksh op on Financial Innovations for Biodiversity Br atislava ,Slovakia.

[8] Li Xi.Foreign Green Finance Policies and Th eir References [J].Journal of Soochow Universit y,2011(6).

[9] Zhang Zhaoxi,Zhao Xinye.’Problems and Solu tions of Green Finance’: 2013

[10]Zhong Yuping.’Research on the Current Sta tus,Problems,and Countermeasures of Green Fi nance Development in China’: 2016 (6)

[11]Huhongzhang.’On the Sustainable Develop ment of Finance’ [M].Beijing: China Financial P ublishing House,1998.

[12] Guangzhou Carbon Emission Exchange website

[13]Guangdong Province Green Finance Invest ment Holding Group Co.,Ltd.Website

[14]Guangdong Provincial Government Portal

[15]Jiangmen Finance

[16]Ni Quan Hong.’China Finance’: 2016

[17]Zhang Jin,Zhao Xianchao.’Research on the Promotion of Low-Carbon Economic Developm ent by Green Finance’: 2011

[18]Caijing Network

[19]Li Simin,’Using Monetary Policy Tools to P romote Green Credit: Ideas,Objectives,and Mec hanism Design,’ Guangzhou Branch of the Peo ple’s Bank of China,2016 (9)

[20]Xu Wen,’Research on Fiscal and Tax Polici es to Promote Green Finance Development,’ P ublic Revenue Research Center,Chinese Academ y of Fiscal Sciences,2016

[21]Gao Xuefei,Zhao Chao.Initial Exploration of Financial Innovation Supervision System in Sh

anghai Free Trade Zone [J].Financial Economics, 2014(20)

[22]Pei Qingbing.’Comparative Study of China’s

Energy Use Rights Trading and Other Resourc e and Environmental Rights Trading Systems,’ Energy Research Institute,Chinese Academy of Macroeconomic Research,Beijing,100038

[23]Cai Yinghui.’Comparison between Energy U se Rights Trading and Carbon Emission Rights Trading,’ School of Law,Shanghai University,200 444

[24]Wu Fan.’Guangdong’s Pilot Program for Po llutant Emission Rights Trading Enters the FastLane’

[25] Chen Hui Lu,Zhong Qi Zhen.’Guangdong E mission Rights Trading Pilot Launched’

[26] Liu Hui Yue.’Investigation of Financial Supe rvision Mechanism in Guangdong Free Trade Z one’: Jinan University Shenzhen Tourism Colleg e,Guangdong Shenzhen,518053

[27] Guangdong Provincial Development and Re form Commission.’Green Ecology,Beautiful Gua ngdong – A Summary of Guangdong Province’s Pilot Work on Carbon Emission Trading’

[28] Guangdong Province,Guangzhou City Green Finance Reform and Innovation Pilot Zone.Bai

du Encyclopedia.2017